5 Common Questions On Filling Tax Returns | 填寫報稅表的5個常見問題

Stepping into April, you will receive the green envelope in your mailbox. That means it is time to file your tax return. You might be experienced on the tax filing however there are some common issues that you may miss. Please take a look at the following 5 commons questions on filling the tax returns.

- Do I need to file my tax if I have not received the green envelope?

Yes, you must file the tax return to IRD if your salary is higher than the income allowance (the basic income allowance is HK$ 132,000 in 2021). Once you must contact the Inland Revenue Department (IRD) if you do not receive any tax forms. Otherwise, IRD will initiate legal action against you.

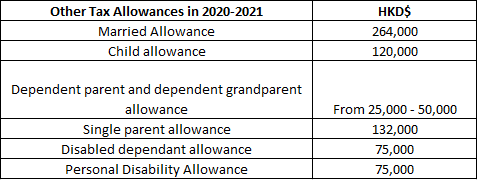

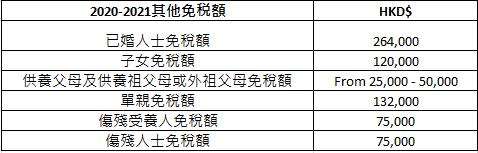

- What allowances are available in HK?

As we mentioned the basic allowance, HK Government summarised the tax allowances based on the taxpayers’ individual situation. You could find out in the list below which aspect is benefited for your needs:

- My MPF contribution will be deducted from the tax calculation?

For the account holder, only voluntary contributions could enjoy tax deductions under the salaries tax. You may wonder about the limitation of tax deductible. For people who are eligible, the tax-deductible limitation per year is HK$60, 000.

- Which documents I need to prepare to IRD?

Before you hand in the documents to IRD, please make sure that all documents are certified by public accounts (CTC Copy from CPA):

- Certified Copy of Balance Sheet, Audit Report, Statement of Profit & Loss

- A Tax Computation

- Completed Tax Return Forms

- What Should I do if I am not familiar with HK Tax System?

We highly recommend assigning your accounting & audit issues to local professional services provider. Since they have lot of experiences on handling taxation, you will reduce the time and stress on this issue.

Tax season is coming, have you started preparing the accounting & audit issue? KPC Business Centre has 12 years experiences. Please feel free to drop us an email at [email protected] / Whatsapp us +852 9168 9205 anytime if you have any related Acc & Audit difficulties.

踏入四月,您將會收到一個税務局(IRD)的綠色信封。這意味著是時候提交報稅表了。您可能在報稅方面有不少經驗,但也可能會遇上一些常見問題。本週的Blog中, 我們會分析有關填寫報稅表的5個常見問題。

1.如果我沒有收到税務局的綠色信封,是否需要報稅?

是的,如果您的工資高於指定的免税額(2021年的基本免稅額上限為132,000港元),則必須向稅務局提交報稅表。如果您沒有收到任何報稅表,則必須與稅務局(IRD)聯繫。在沒有通知稅務局的情況下延遲交稅,稅務局會對您提出法律訴訟。

2.香港有哪些種類的免税額?

除了我們提到的基本免稅額外,香港政府根據納稅人的具體情況匯總了各項免稅額。您可以在下面的列表中找到哪些一種適合您的情況:

3.我的強積金供款可在稅款中扣除嗎?

對於賬戶持有人,只有可扣稅自願性供款的用戶才能享受稅減免稅。符合資格的人士,每年可扣稅的上限為HK $ 60,000。

4.我需要向稅務局準備哪些文件?

在將文件提交給税務局(IRD)之前,請確保所有文件均已通過特許的人士或機構認証(例如來自會計師樓的文件認証副本):

- 資產負債表,審計報告,損益表的認証副本

- 稅收計算

- 完整的報稅表

5.如果我不熟悉香港稅制,該怎麼辦?

我們強烈建議您將會計和審計工作交給本地專業服務供應者。由於他們在處理稅務方面有豐富的經驗,因此您可以減少時間和壓力處理此問題。

稅季即將來臨,您是否已開始準備會計和審計工作? 尖沙咀商業中心擁有12年的經驗。如果您遇到任何會計和審計的困難,請隨時通過[email protected] 向我們發送電子郵件 / Whatsapp 我們 +852 9168 9205。