3 Types of Tax Return You Need To Know | 您需要知道的3種報稅表

Time files when we are facing the dramatically changing of the world in 2020. The new year is coming, which means time to review your business strategies and do not forget the tax due date also. In order to continue to operate your business operation smoothly, make sure all of the local compliances are met.

We understand that managing tax filing deadline and accounting documents are time consuming especially to foreign entrepreneurs. Therefore, we would like to share our experiences about this issue to you before the tax season comes in April.

Salaries (Individual) Tax Return

For Individual Tax Return, you need to complete your tax return for reporting all your employment income, profits from sole business, rental income from owned properties as well as claiming deduction in one return. A director remuneration is also taxable and require to be reported annually.

Basically, the Inland Revenue Department (IRD) will deliver the tax return to you annually in the first working day in May and the normal filing date is 2 June/July. If you have not received the form from IRD, you have to inform IRD by writing a letter when you become chargeable to tax no longer than 4 months after the end of the basis period for the year of assessment.

Employer’s Tax Return

As an employer, you have obligations to keep payroll records of your staff and report remuneration paid to employees by completing and filing the employer’s return on time. Officially, the Inland Revenue Department (IRD) will issue the employer’s return to employers on the first working day of April. The employer is required to complete the details and submit the record to the government within 1 months after receiving the letter. Even if your company do not have employee in the reporting period, you are still required to file the return to the government on time. It is a kindly remind that failure to file the employer’s return on time is subjected to government late filing penalty of HK$10,000. You have to pay attention on the statutory period for notification. Penalty of HK$10,000 will be imposed charged the employer of you are failure to comply the IRD’s requirements.

Profits Tax Return

Any person who is carrying on any profession and business in Hong Kong no matter you are local or non-residents, are subject to the Hong Kong Profits Tax.

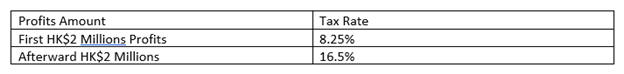

A company is required to prepare its audited financial statement and file its profit tax return to the Inland Revenue Department within one month after received the tax return. Here is the current profit tax rate for your reference:

For profits tax return, the issue date is normally set in the first working day in April. And the filling date for all cases is 2nd May. That means you need to fill the profit tax within one month normally. Recently, HK government is encouraging electronic filing. A further extension of 2 weeks after the normal due date is available for small corporation business who will file the profits tax return via online method.

KPC Business Centre has 12 years experiences with providing professional accounting & audit arrangement services. Looking for a professional accounting consultant? Please feel free to drop us an email at [email protected] / Whatsapp us +852 9168 9205 anytime.

新的一年即將到來,這意味著您有時間回顧您的業務策略,同時也不要忘記交稅的日子。為了使您的業務繼續順利運作,請確保交稅時已符合所有本地的法規。 在過去12年經驗告訴我們,許多外國在港的企業家可能會遇到困難,尤其是稅務局的稅收安排。因此,我們希望在4月的稅收季度來臨之前向您分享我們的經驗。

薪俸稅申報表

通常,所有已經在香港工作超過一年的人士。對於個人薪俸稅申報表,您需要填寫您的稅務申報表

表格BIR60,以通報您的所有收入,單一業務利潤,自有物業的租金收入。基本上,税務局(IRD)會在每年的5月的第一個工作日向您發出報稅表,而正常的提交日期是6月2日/ 7月。如果您沒有收到IRD的通知,您必須在您應課稅年度的基準期結束後不超過4個月,寫信通知IRD。

僱主報税申報表

許多外地企業可能並不了解香港的稅制。作為僱主,您有義務保留員工的工資記錄並通過填寫 僱主填報的薪酬及退休金報税表來通報稅局支付給員工的薪酬。稅務局將於4月的第一個工作日正式向雇主發放報税表。謹在此提醒您,您必須注意法定的通知期限。如果雇主未遵守税務局的要求,最高罰款為10,000港幣的罰款。

利得稅報稅表

不論您是香港居民或國內/海外人士,如您或經營任何業務,每年都必須向稅務局提交及申報相關的利得稅報稅表。以下是香港的稅率供您參考:

對於利得稅報稅的發布日期通常設置在4月的第一個工作日。所有案件的遞交日期均為5月2日起,您通常需要在一個月內填寫利得稅。最近,香港政府正在推廣電子申請。對於小型公司,如果使用線上方式遞交將利得稅報稅表,可申請延長2週遞交。

尖沙咀商務中心擁有12年的經驗提供專業的會計和審計服務。 尋找專業的會計顧問? 請隨時通過[email protected] / Whatsapp給我們+852 9168 9205。